Cars are a popular mode of transportation all over the world. However, with the increasing number of global car accidents each year, the importance of car insurance cannot be overstated.

One of the most commonly asked questions includes why is insurance so expensive for teenage drivers.

Being engaged in the automotive industry for over a decade has given me the ability to respond to this question most appropriately. So, let’s get into the specifics.

Why is Insurance So Expensive for Teenage Drivers?

Insurance companies charge their customers based on the risk that each individual poses. A person who appears to be a higher risk to the insurance company must pay a higher premium. Because most teenage drivers drive recklessly, they are involved in a higher number of accidents.

Statistics back up this assertion. According to studies, 25% of all road accidents involve people under the age of 25. This is why teen insurance is so expensive.

Here are some of the reasons that aid it pushing up the insurance premium for teenage drivers:

1. Less Experienced Drivers

When it comes to driving, most teenage drivers are untrained. This means they are unfamiliar with the intricacies of driving a car.

Such drivers do not fully understand the road signs and frequently forget even the most basic aspects of car driving, resulting in accidents. As a result, such people are more likely to be involved in car crashes.

This raises the repair costs for their insurance companies, and as a result, such companies charge teenagers higher rates.

Maturity is typically acquired with age. Most teenagers don’t seem to think beyond the present moment, which means they perform tasks without considering the consequences or retaliation. Thus, their actions commonly have negative outcomes.

Such drivers are more likely to be involved in road rage, which can easily result in significant damage to their vehicles. Because the insurance company must bear the cost of vehicle repairs, they keep the premium high.

Furthermore, it has been observed that more than 25% of all individuals aged 18 to 24 are involved in a car accident within the first two years of receiving their driver’s license.

Also read: Is it Safe to Drive at 3 am? How to Drive at Night?

2. Innate Ability to Drive Rashly

The excitement with which most teenagers drive is typically missing in mature drivers.

Motorists in their golden years tend to drive slowly and as per the rules. Teenagers, on the other hand, have a passion and craze for driving fast. They do it for a variety of reasons, including the desire to impress their peers. Such rash driving is frequently the root cause of traffic accidents.

This reckless driving elevates the risk level for insurance companies, so in order to avoid losses from such customers, they usually keep the premiums high.

3. Lack of Proven Record

Another factor that contributes to higher insurance rates for teen drivers is a lack of proven records.

The corporate world is entirely reliant on the record. That is why, before taking any action, companies look at an individual’s past performance to get an idea of how he is likely to perform in the future.

If the person’s record is clean, he or she is expected to be sober in the future. On the contrary, if the record demonstrates misconduct, the individual is likely to repeat his mistakes in the coming times as well.

Teenagers purchasing their first vehicles have no track record to back up their claims. As a result, it is extremely difficult for an insurance company to predict how the individual will perform.

Trending Video: How to Easily Bring Back to Life any Old Car Battery and Save Tons of Money (click to watch)

All they can do is guess, but a wrong guess can cost the insurance company hundreds if not thousands of dollars. This is why all such companies keep the insurance cost high for teenagers so in case anything goes wrong, they have a provision to cover the costs.

4. Young Drivers are Easily Distracted

The majority of middle-aged or elderly people are unlikely to use their cell phones while driving. A teenager who texts frequently, on the other hand, is more inclined to check his messenger or respond to a text while driving.

Similarly, young drivers are more likely to be distracted by things like signboards, infotainment systems, eating while driving, or applying makeup while driving.

This puts such drivers at a higher risk than seasoned drivers who understand that such actions can result in fatal accidents.

Also read: Are Hatchbacks Cheaper To Insure? Checked!

5. Involvement in More Accidents

As previously stated, young drivers, particularly males, are involved in the majority of road accidents. They are more inclined to perform various stunts on the roads, which can often lead to unfavorable situations.

As a result, their car insurance premiums are much higher than those of older drivers with more experience.

How Much Does a Teenage Driver Pay for an Insurance?

A 17-year-old male teen pays an annual insurance premium of $2200 on average, whereas a relatively experienced 25-year-old male driver pays an insurance premium of $1500 for the same period.

These numbers vary slightly for female drivers, but the general scheme remains the same: insurance premiums for experienced drivers are much lower than for new drivers due to the high risk associated with it.

At What Age is a Car Insurance Cheaper?

Insurance is cheapest for men and women over 60 years of age. The reason is that these people usually drive their vehicles at very slow speeds and that too with extreme care, thereby minimizing the chances of accidents.

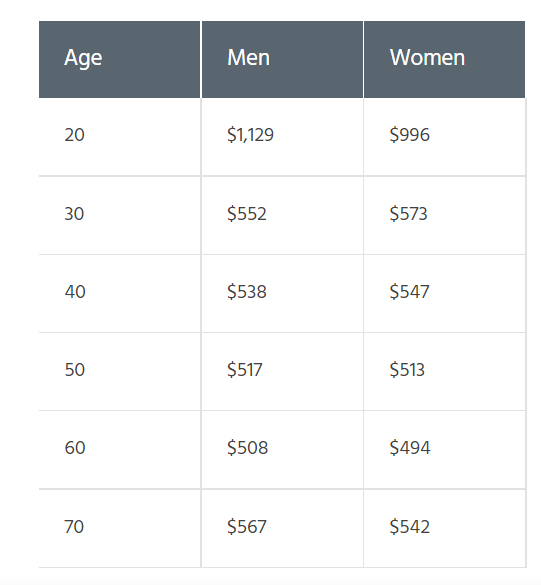

The below-mentioned chart provides a great opportunity to take an insight into the car insurance premiums associated with male and female drivers of different ages:

For drivers between the ages of 16 and 21, the overall insurance cost plummets and keeps going down as the age increases.

Also read: Buying a Car with 100k+ Miles? All You Need to Know

Does Gender of a Teenager Affect Car Insurance Price?

Yes, the gender of a teenager plays a significant role in determining the car’s insurance price. Here is how much an average teenage driver pays for car insurance annually:

- 17 Year Old Male: $2227;

- 17-Year-Old Female: $2059;

On the other hand, here is how much 25-year-old male and female drivers pay annually for their insurance:

- 25 Years Old Male: $1827;

- 25 Years Old Female: $1744;

These are large numbers demonstrate that teenage drivers are considered extremely high-risk by car insurance companies.

So the good news is that as you get older, you’ll have to pay less for car insurance because the insurance company will start trusting you more.

How to Make Teenage Driver’s Insurance Cheaper?

There isn’t much that can be done to reduce a teen driver’s insurance premium because statistics and a lack of historical data make it difficult to do so. However, one strategy that many parents use around the world is to include their teenagers in their own policy.

In this way, parents can allow their teenagers to drive their cars while only paying a fraction of the insurance premiums that they would have had to pay under their own insurance policies.

According to research, using this method can save you up to 40% of the cost, making it a viable option to consider.

Which Companies Offer Cheap Insurance for Teenage Drivers?

Insurance is an expensive matter, and with annual insurance premiums easily escalating to humungous figures, finding a low-cost and dependable insurance option is critical. As a result, here is a list of various companies that provide low-cost insurance for teen drivers:

- Nationwide

Thanks to it its extremely low rates for adding teenage drivers to the insurance policy of their parents, Nationwide outperforms all competitors with ease and is thus one of the preferred insurance companies by a multitude of clients.

- USAA

A cheap insurance company is nothing without great customer service and this is where USAA stands out by not only offering the lowest rates but also delivering results.

- Progressive

Progressive has customer service that is backed up by exceptional technology that aids the company in providing state-of-the-art services at competitive rates.

- Erie

Erie’s teenSMART package is particularly designed for teenage drivers and thus offers the best in class rates with outstanding services.

- American Family

The Teen Safe Driver Program of the company is a great way to keep your teenagers covered and that too at reasonable rates.

- Geico

Geico clubs together customer satisfaction, coverage, and reasonable rates thereby making it one of the cheapest and the best insurance policy options for teenagers.

- Allstate

Allstate is different from all other companies in the list principally because it offers not only the conventional usage-based insurance policies but also the pay-per-mile facility which dramatically reduces the overall insurance price for adding teenagers to the policy of their parents.